Trading, investment, fund management or exchange, protocols on the Ethereum blockchain are working towards one common dream — a global, shared liquidity pool. #LendroidExplains why this is important to the survival of the blockchain.

I’ll let you soak in that for a second. Ah, trust-independent paradise.

An Imperative, Not a Luxury

Cut a slice of the upcoming projects on Ethereum right now. There’s a world of promise –

- Truly decentralized exchange ecosystem built on 0x, which a collective of relayers — The 0cean, Amadeus, Radar Relay, among others — are now running with.

- There’s fund managers like Melonport in the fray, who have espoused trust-independence and transparency, a step up from conventional versions.

- There are funding protocols like Neufund that talk of a capital pool for promising ventures.

- And then there are the trading protocols like Lendroid with grand ambitions of bringing about complex financial instruments on to the blockchain, with addictive user experience and minus the drag of on-chain computation.

For any or all of these to survive, sustain and grow, they need one thing in common — that shared lending pool. No one protocol can bring in the kind of liquidity necessary for its guaranteed existence. It will have to be a collective.

Therefore, this is an imperative, not a luxury. It’s as simple as that, and as profound.

Working Backwards

Here’s a look at how Lendroid goes about enabling that shared lending pool –

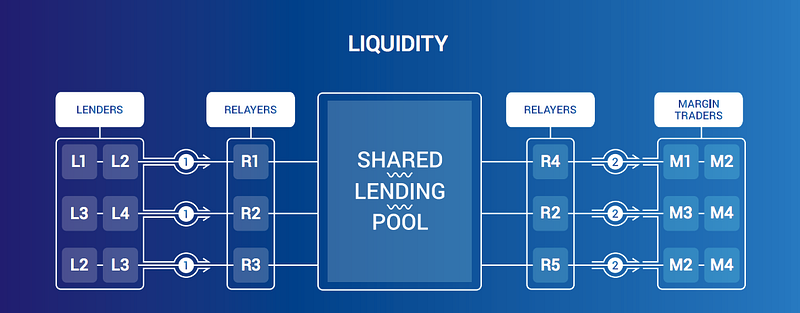

As you can see from the image above, there are three key participants on the protocol –

- The Lenders

- The Relayers

- The Margin Traders

The relayers are like conduits through which liquidity flows in and out. The Margin Traders draw liquidity to participate in trade, and finally, the stars of the show, the Lenders, contribute liquidity into the protocol.

The best part is that the liquidity that flows through one relayer R1 is not exclusive to that relayer. It can be accessed by another relayer R5. Meanwhile, when a trade is completed, yet another relayer R4 contributes to the lending pool.

A Super-Protocol?

Interestingly, protocols have begun to identify points of convergence and work towards building alliances amongst themselves. They not only realize the importance of capital flow to their own protocols, but are able to see the value of collaboration, and perhaps a glimpse of a super-protocol, enabled by that lending pool.

Imagine a collective of all those hyperlinked protocols, and an unlimited number of new ones, all pooling resources, drawing from it, making it work and grow.

Komentar

Posting Komentar